Leverage can magnify returns if you are right, but it can also lead to ruin if you are wrong. If you invest smartly you don’t need the leverage to begin with. And if you do use it, watch out.

Trading offers endless possibilities and the promise of big profits, but there’s a factor that can be both an ally and a destroyer: leverage. Leverage lets traders control larger positions with less capital, creating the potential for huge gains. But let’s be clear - it’s a double-edged sword. Without a solid strategy and strict risk management, leverage can lead to severe losses, even financial ruin.

Why Very Few Day Traders Succeed

The dream of day trading attracts people with the lure of fast profits. But here’s the reality check: only a tiny percentage of day traders actually succeed. Studies show that 80-90% of new traders lose money within their first year. The odds are stacked against you because of intense competition, emotional decision-making, and, most of all, the risky misuse of leverage.

Leverage: Your Best Ally or Worst Enemy

Leverage is a multiplier for both gains and losses. When used wisely, it amplifies profits. A leverage ratio of 10:1 means a 1% gain in the asset results in a 10% gain on your capital. That’s the dream scenario, and it’s why leverage can be so tempting.

But the flipside is just as intense - a 1% drop means a 10% loss. Misuse leverage, and you can wipe out your account faster than you’d imagine. A few bad trades with too much leverage can eliminate months of gains in minutes.

The High-Stakes Game of Leverage

Trading with leverage is like playing with fire. If you don’t know what you’re doing, it can quickly get out of control. Many new traders, overconfident from a few wins, increase their leverage without understanding the risks, only to be blindsided by sudden losses. The market doesn’t care about your confidence; it moves on its own terms.

Here’s what you need to keep in mind before using leverage:

- Learn the fundamentals of trading strategies, technical analysis, and risk management. In trading, knowledge isn’t just power - it’s survival.

- Start with small leverage and build experience before scaling up. Avoid the rookie mistake of overextending too soon.

- Set clear loss limits and exit points - because sometimes the smartest move is knowing when to cut your losses.

- Stay calm and disciplined during volatile markets. Trading isn’t just numbers; it’s about mastering your mindset.

Leverage can be your greatest asset or your biggest liability. Used wisely, it amplifies profits. Used recklessly, it leads to financial disaster.

Disclaimer: This is for educational purposes only and is not financial advice. Always consult a financial professional before engaging in leveraged trading.

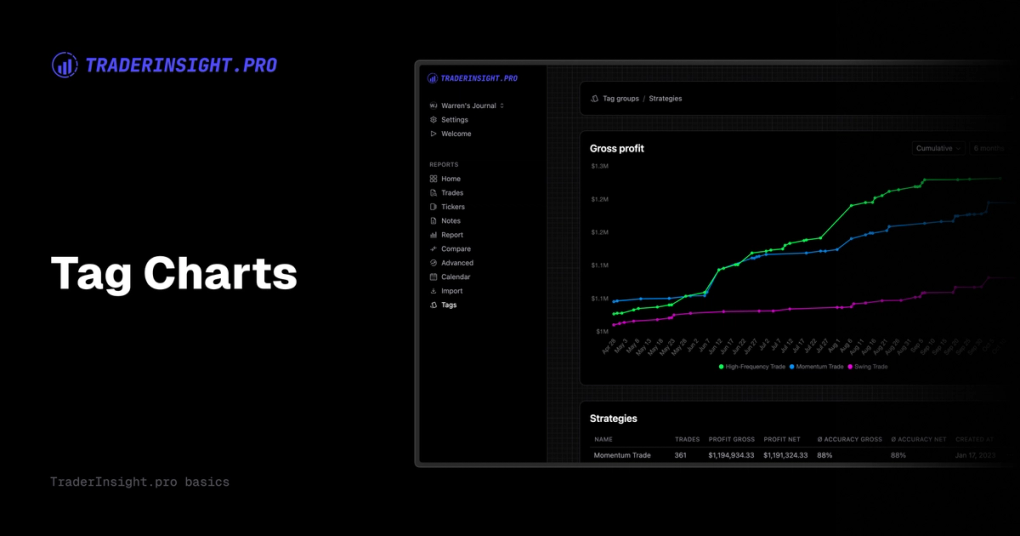

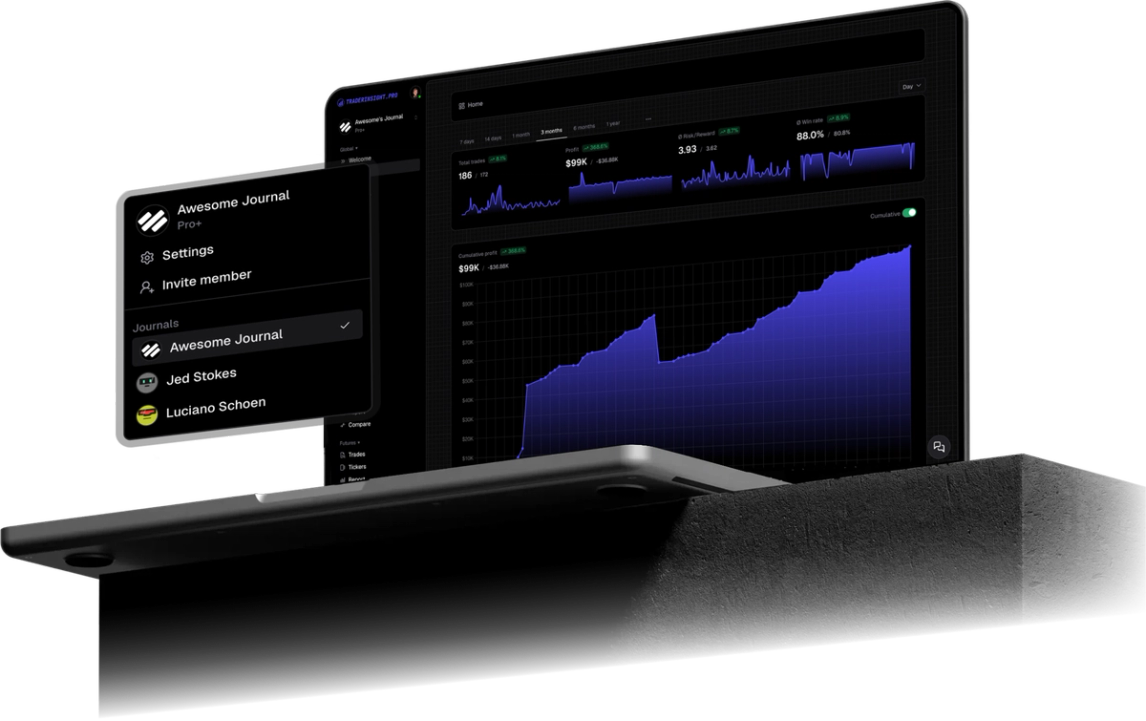

For traders looking to understand and manage the risks of leverage more effectively, having a reliable trading journal is essential. TraderInsight.pro is built by traders, for traders, to help you keep track of every trade, analyze your strategies, and gather insights that can lead to smarter decisions.

By logging your trades, you’ll gain a deeper understanding of how leverage impacts your performance, helping you maximize gains while minimizing risks. Start journaling with TraderInsight.pro today and turn your trading experiences into powerful lessons for future success.