Forex Trading Journal

Capture setups. Review sessions. Track performance.

Trading the same pairs every day… but getting different results?

Maybe it's market open. Maybe it’s your own execution. Or maybe it’s just noise. Journaling helps you cut through it.

Log your trades, add context, and spot the patterns that actually matter - by time, pair, or setup. Get clarity, get better.

Context over chaos

Record reasoning, volatility, liquidity conditions - the stuff that screenshots miss.

Get data by pair & session

Break down trades by instrument, time of day, weekday, or session overlap.

End-of-Day Recap

One note for all trades - review mood, focus, execution. Log what you’d coach yourself on if you were the mentor.

Tools build for Traders

Pair-Level Stats

Get performance breakdowns by each FX pair - see where you actually make money.Session-Based Filters

Track by London, NY, Tokyo or overlap. Slice your data by when you actually trade.Entry Timing Breakdown

How long after your signal do you enter? Spot timing delays and overreactions.Compare Setups

Stack your breakout vs. mean-reversion setups and spot which delivers better risk-adjusted results.Daily Pattern Detection

Group trades by weekday and session to find hidden trends in volatility and win rate.Track Mistakes

Tag emotional entries, late exits, overtrading, and more. Use it as a mirror - no judgment.Private Journal Access

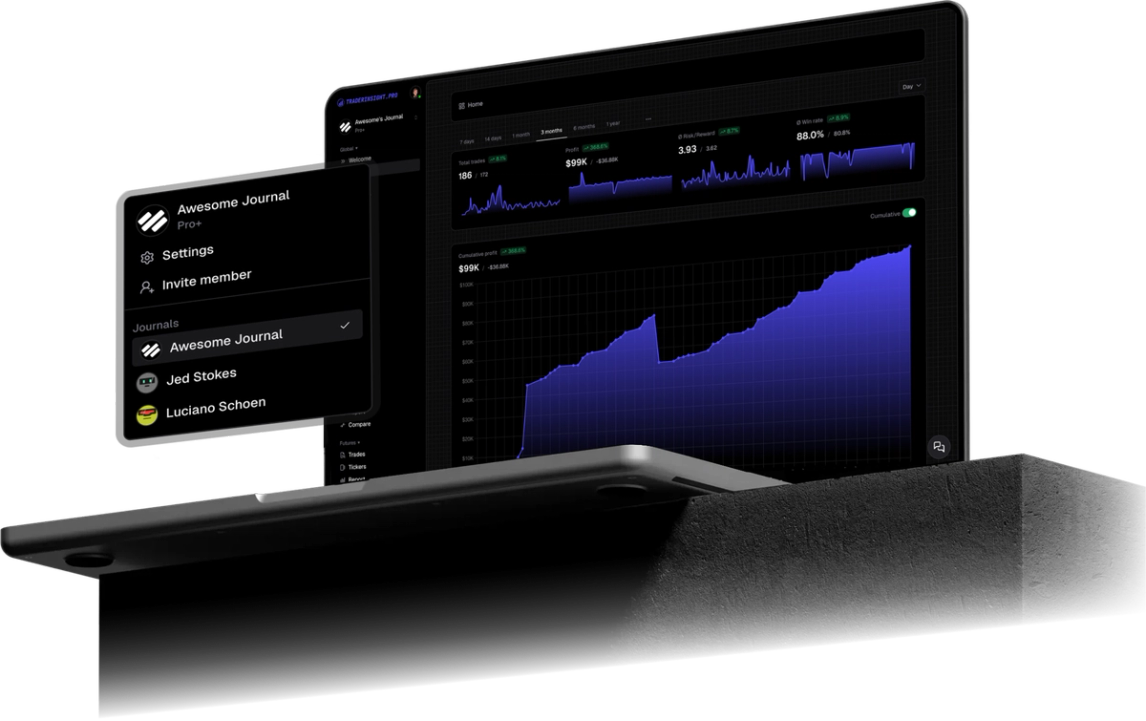

Invite accountability partners or mentors to view your journal in read-only mode.Multi-Broker Support

Import from anywhere - we’re broker-agnostic.Performance by Week or Month

Zoom out to spot long-term trends, big wins, or frustrating slumps.Tag Your Strategy

Whether you trade breakouts, retests, or fibs - tag and track it all.Answer all of these questions (and more) with TraderInsight.pro.

- Am I more profitable in the London or NY session?

- Which pair gives me the cleanest trades?

- Are my Monday trades usually rushed?

- What’s my average stop loss in pips?

- How long do I hold winning trades?

- What’s my best setup this month?

- Do I size up too much after wins?

- How often do I revenge trade?

- How often do I exit too early?

- Do I overtrade on Fridays?

FAQ's

Discover answers to frequently asked questions right here. If you can't find what you're looking for then reach out.

Which forex brokers does TraderInsight.pro support?

TraderInsight.pro supports forex trading from Interactive Brokers, MetaTrader 5, Charles Schwab, TradingView Paper Account, HankoTrade, GatesFX, Pepperstone, and other major FX brokers. MT4/MT5 platform support makes it compatible with hundreds of brokers.

Can I analyze forex trades by trading session?

Yes, use TraderInsight.pro's custom tagging to categorize forex trades by session (London, New York, Asian, overlap periods). Identify which sessions produce your best results and optimize your forex trading schedule accordingly.

Can I track multiple forex currency pairs separately?

Yes, TraderInsight.pro allows you to filter and analyze each currency pair (EUR/USD, GBP/USD, USD/JPY, etc.) individually. Compare performance across majors, minors, and exotics to find your most profitable forex markets.

Does TraderInsight.pro support forex scalping strategies?

Yes, TraderInsight.pro fully supports high-frequency forex scalping. Import large volumes of trades, tag by scalping strategy, analyze performance by time of day, and identify optimal scalping conditions for each currency pair.

Ready to track your edge?