Swing Trading Journal

Swing trading is about timing, patience, and precision. TraderInsight.pro helps you track the setups, strategies, and outcomes that matter - across days, weeks, or even longer.

Swing traders don’t need 20 trades a day - just a few good ones with strong conviction. But if you don’t journal, it’s easy to lose the why behind the move.

Why did that breakout fail? Was it earnings? The market? The entry?

With TraderInsight.pro, you log what matters. Not just the PnL - but the context, the reasoning, the follow-through. You start seeing patterns in your own playbook. What setups work best? What timing suits your style? What mistakes creep in after a few green trades?

Journaling isn't busy work - it can help you to figure out what actually works.

Import Trades from any broker

Import trades from any broker in seconds - Stocks, Forex, Crypto, Options, Futures, Dividends... everything

Track all strategies, mistakes and more

Add your custom strategies, learnings and more to each trade to keep track of your thinking and decisions.

Add Notion like notes to each trade

Capture your swing setup, earnings play, or macro context - add Notion like notes to each trade to keep track of your thinking and decisions.

Build custom reports

Setup custom charts, stats and more. See exactly what matters to you.

Compare setups, behaviours, everything

Run different strategies through filters side-by-side based on your past trades to see what works best for you.

Tools build for Traders

Custom Tags & Notes

Capture your swing setup, earnings play, or macro context - add real notes, not just ticker + date.Hold-Time Analytics

Group your performance by 1-day, 3-day, 7-day, or longer holds to refine your exits.Compare Setups

Test which setups work best: breakouts, reversals, continuation gaps - all fully filterable.Performance by Week or Month

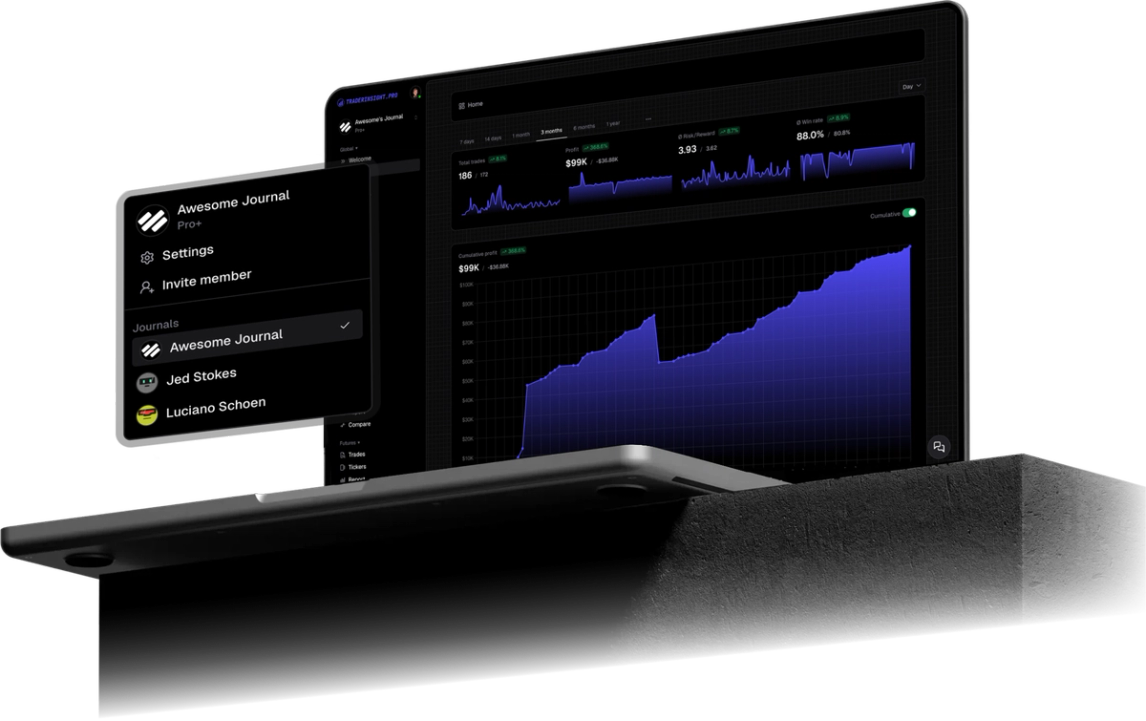

Zoom out. Track performance across weeks, months, or market conditions.Private Journal Access

Invite a mentor or accountability partner to follow your trades without sharing everything.Custom Reports & Dashboards

Build your own views - compare setups, filter timeframes, track exactly what matters to you.Entry vs. Exit Timing

Drill into how early or late you're entering and exiting. Improve timing, not just direction.Track Emotions & Psychology

Log confidence, hesitation, FOMO - and see how your mindset impacts results over time.Refine Your Target Zones

See where your exits hit - too early, too late, or just right. Learn to let winners run without guesswork.Import From Any Broker

Upload trades from any broker in seconds - CSV, Excel, whatever you’ve got. Clean data, no hassle.Answer all of these questions (and more) with TraderInsight.pro.

- Am I more accurate when I swing through earnings - or should I avoid them?

- How do my breakout trades compare to pullbacks over the last 3 months?

- How does my win rate change when I hold for 2 vs. 5 days?

- Am I cutting winners too fast, or holding losers too long?

- What's my best performing strategy and why?

- Why did I sell too early on that 3-day runner?

- What’s my best day of the week for entries?

- Which sectors or caps perform best for me?

- How do my emotions impact my trades?

- Do I trade better in trends or ranges?

- Am I overtrading Fridays?

FAQ's

Discover answers to frequently asked questions right here. If you can't find what you're looking for then reach out.

How does TraderInsight.pro help swing traders?

TraderInsight.pro helps swing traders analyze performance across different hold durations, compare strategies in various market conditions, and identify which setups yield the best risk/reward ratios. Tag trades by strategy, hold time, and market environment to refine your edge.

Can I analyze trades by hold duration?

Yes, TraderInsight.pro allows swing traders to filter and analyze trades by hold duration. Compare your 3-day holds vs 2-week holds, identify optimal holding periods for different strategies, and see how performance varies across time horizons.

Does TraderInsight.pro support multi-leg options strategies?

Yes, TraderInsight.pro fully supports multi-leg options strategies common in swing trading, including spreads, straddles, and iron condors. Import trades from any broker that supports options and analyze the complete performance of complex positions.

Can I compare swing trading performance across different market conditions?

Yes, use TraderInsight.pro's custom tagging system to label trades by market condition (trending, ranging, volatile, etc.), then compare performance across these scenarios. This helps identify which strategies work best in different market environments.

Is TraderInsight.pro suitable for position traders too?

Yes, TraderInsight.pro works for position traders holding trades for weeks or months. The platform supports all hold durations and provides analytics for long-term performance tracking, dividend capture strategies, and multi-month position analysis.

Start tracking your swing trades today.