Most traders can tell you roughly which strategies they use. Very few can tell you which ones are actually profitable, how often they execute them correctly, or what their average P&L per strategy looks like over the last 90 days. The data exists - it's just never been organized in a way that makes it answerable.

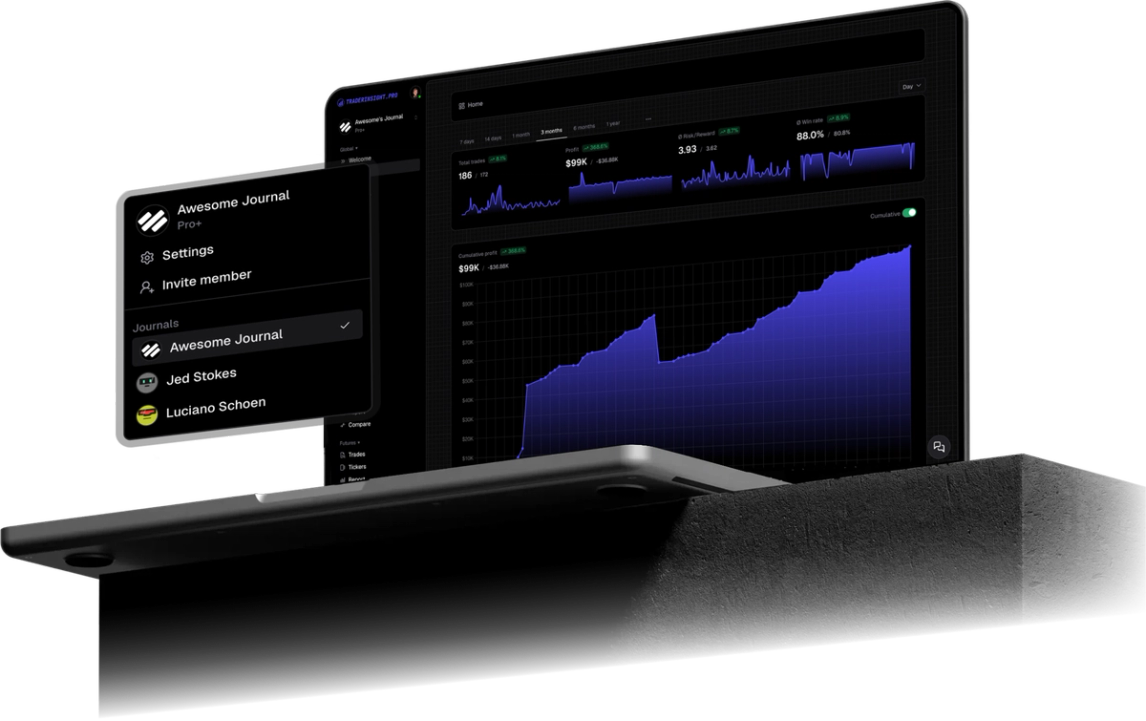

Tags in TraderInsight.pro are how you organize that data. You define the structure - tag groups like Strategies, Mistakes, Market Conditions, Learnings, or anything else that matters to you - and within each group you create the tags that fit your trading. Every tag can have a name and an optional description so the labels stay consistent and mean the same thing six months from now.

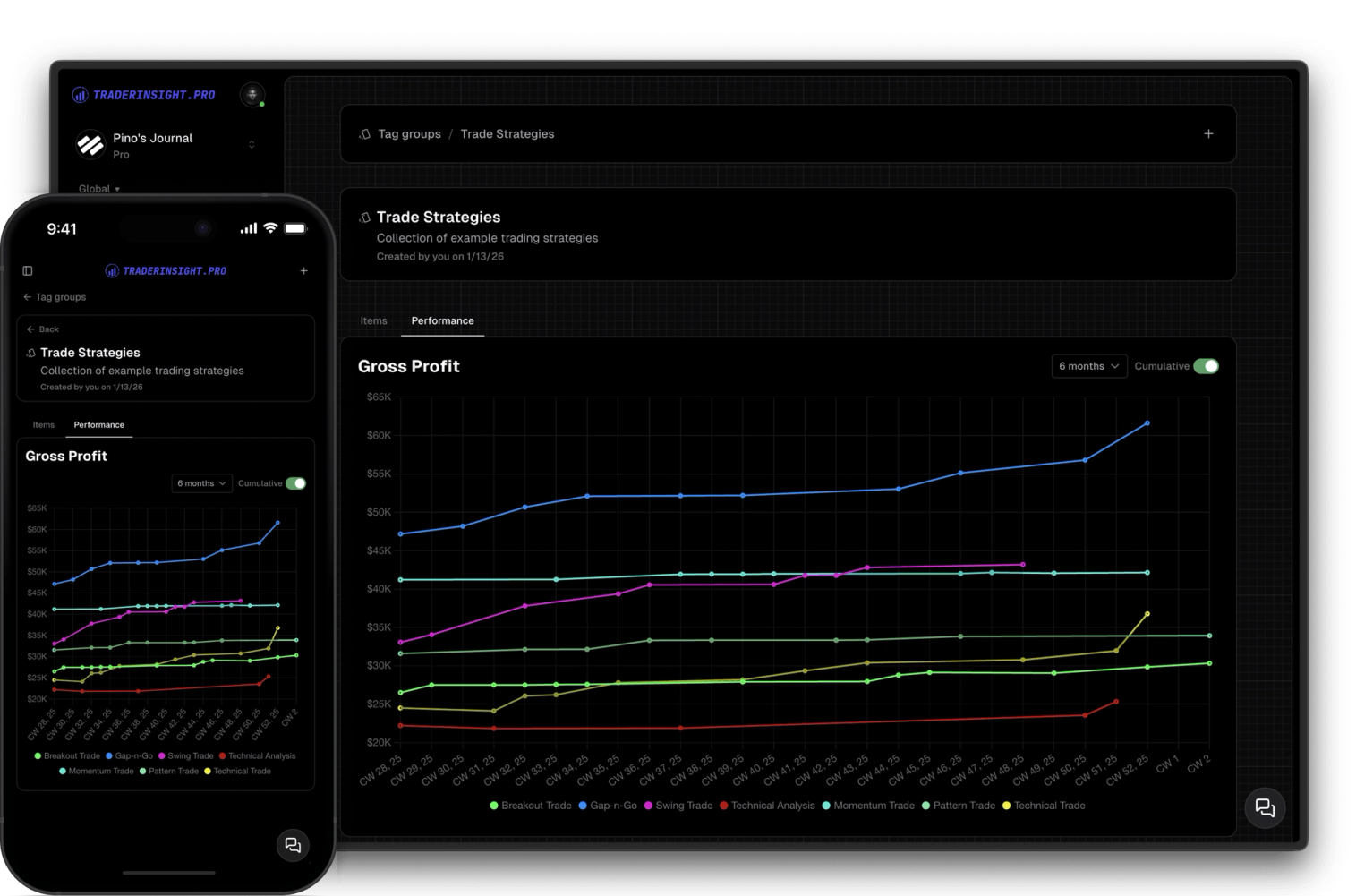

Once tags are attached to trades, everything else unlocks. Filter your trade list by any tag or combination of tags. Build performance reports and comparison reports scoped to specific tags. And every tag group gets its own dedicated reporting area - with usage stats, gross and net profit per tag, and a chart you can view cumulatively or across any time window you choose.

Build your own tag groups and tags

Create tag groups for whatever dimensions matter to your trading - Strategies, Mistakes, Market Conditions, Execution, Mindset, or anything else. Add tags within each group with a name and optional description.

Attach tags to trades to add real context

Tag the strategy you traded, the mistake you made, the market condition you were in. Every trade goes from a row of numbers to something you can actually learn from - with a clear 'why' behind every entry and exit.

Every tag group gets its own reporting area

Each tag group has a dedicated page showing performance across every tag within it - usage count, gross profit, net profit, and a chart per tag. View results cumulatively or filtered to the last X weeks, months, or years. It's the fastest way to see which strategies are carrying your account and which mistakes are costing you the most.

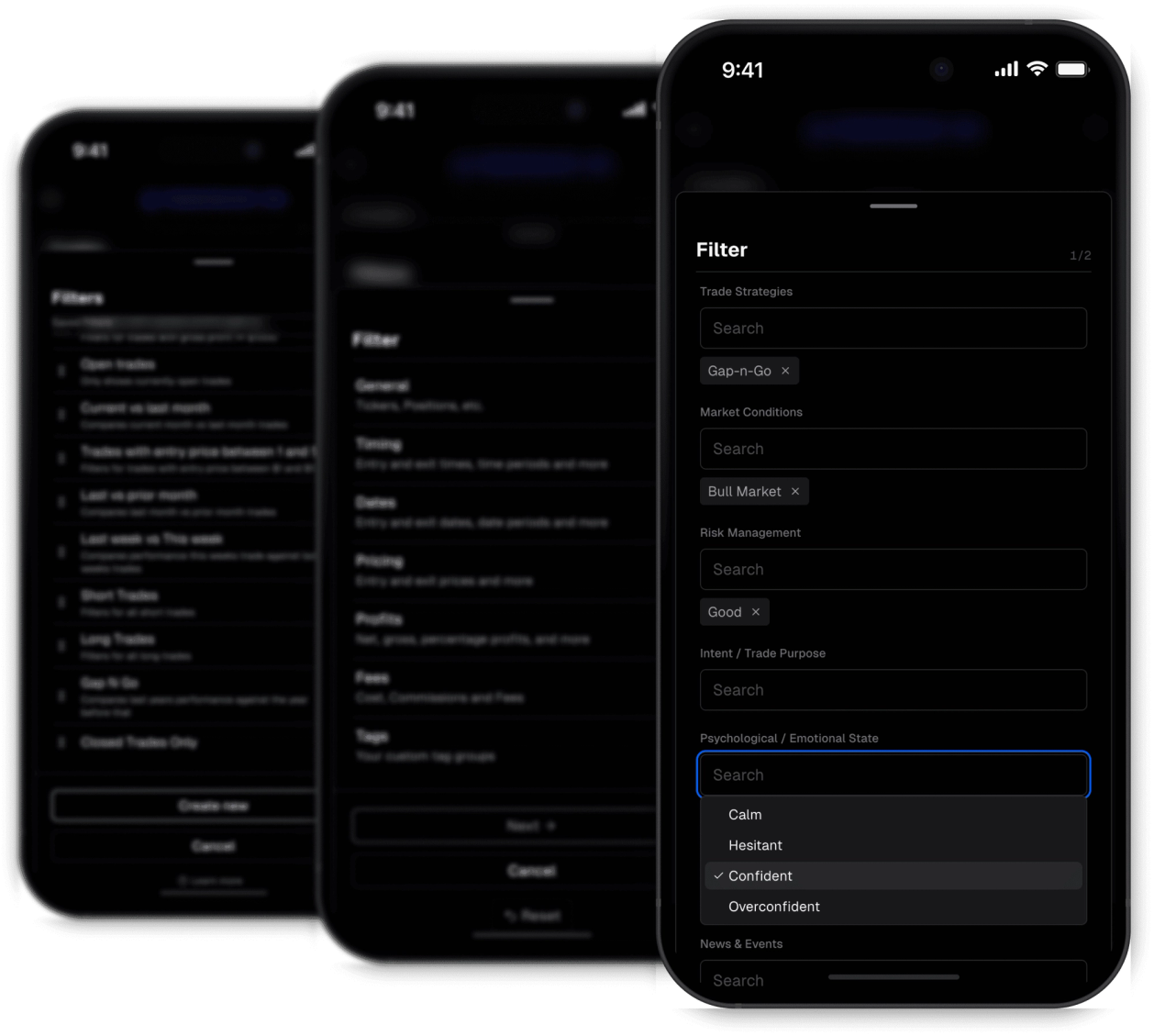

Filter, report, and compare by any tag

Every tag you create becomes a filter condition. Use it to filter your trade list, create a performance report scoped to that tag, or pull it into a comparison report alongside other tags. Your tagging system becomes the foundation of everything you analyze.

How to get the most out of Tags

Start simple

Create 2–4 tag groups first - Strategies, Mistakes, Learnings. Add more only when you actually need them. Complexity that grows naturally sticks better than complexity planned upfront.Define tags clearly

Use the description field to define what a tag means so future-you labels consistently. 'Breakout' should mean the same thing on trade 200 as it did on trade 1.Tag during review, not mid-trade

Tag your trades while reviewing - it's faster and you'll be more objective than when you're in the moment. Import first, tag after.Pick one primary strategy per trade

If a trade fits multiple setups, choose the primary driver. Cleaner tagging means cleaner reports - and cleaner answers.Tag every trade

Don't cherry-pick. Your reports are only as accurate as your consistency. The most valuable data is often in the trades you'd rather forget.Check the tag group reporting area regularly

The per-tag-group reporting page shows usage, gross profit, and net profit per tag at a glance. Make it part of your weekly review.Track mistakes honestly

Mistake tags reveal patterns you can't see in P&L alone. A mistake that costs you $200 each time you make it looks invisible in your overall stats - until you tag it.Compare strategies in a comparison report

Once you have filters built on your strategy tags, pull them into a comparison report. You'll know within seconds which setups are worth trading more of.Evolve your tags as you improve

Rename, split, and refine tags as your understanding grows. A tag system that evolves with you stays useful - one that's locked in too early becomes a constraint.Keep it clean

Avoid near-duplicates like 'Breakout' and 'Break Out'. Consistency is what makes reports meaningful - one tag per concept, always.Tag across all asset classes

The same tag groups work across stocks, options, futures, crypto, and forex. Tag consistently across every asset you trade for a complete picture.Review tag usage monthly

Check which tags are being used and which aren't. Tags with no trades attached are either being skipped or no longer relevant - both are worth addressing.FAQ's

Discover answers to frequently asked questions right here. If you can't find what you're looking for then reach out.

What is a tag group?

A tag group is a category you define - like Strategies, Mistakes, or Market Conditions. Within each group you create individual tags. For example, a Strategies group might contain tags like Breakout, Pullback, and Momentum.

What is the tag group reporting area?

Every tag group you create gets its own dedicated reporting page showing performance across all tags within it - usage count, gross profit, net profit, and a per-tag chart. You can view results cumulatively or filtered to any time window.

How many tag groups and tags can I create?

As many as you need. The exact limit depends on your membership tier - build the structure that fits how you actually think about your trading.

Can I filter trades by multiple tags at once?

Yes. Build a filter with multiple tag conditions - for example, a specific strategy and a specific market condition - and apply it to your trade list, performance reports, or comparison reports.

What's the difference between a tag and a tag group?

A tag group is the category - like Strategies. A tag is the individual label within it - like Breakout or Pullback. Every tag belongs to exactly one tag group.

Can I add a description to a tag?

Yes. Every tag supports an optional description so you can define exactly what it means. Useful for keeping your labels consistent over time, especially as your trade history grows.

Do tags work across all asset classes?

Yes. Tags can be attached to trades across all asset types - stocks, options, futures, crypto, forex, and more.

Can I use tags in performance and comparison reports?

Yes. Every tag is available as a filter condition, and every filter automatically generates a performance report. Pull multiple tag-based filters into a comparison report to rank strategies or mistakes side by side.

Trade better. Tag the trade.