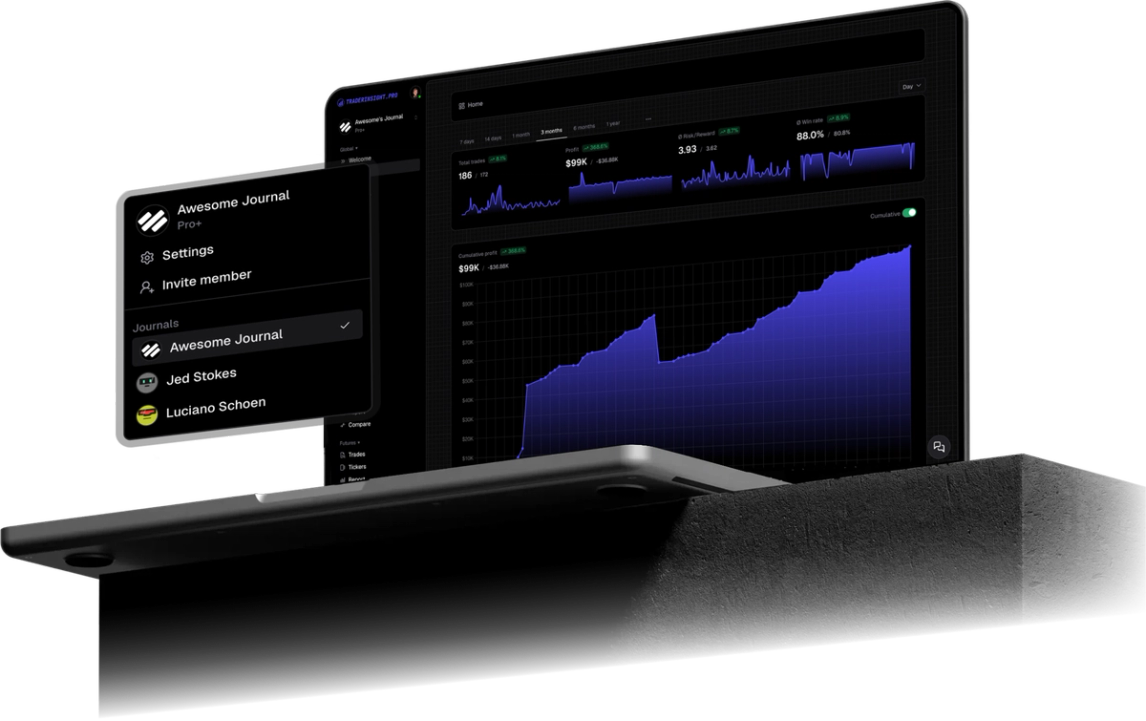

Day Trading Journal

Quick, powerful, and totally customizable. A pro trading journal that finally keeps up with your pace.

You’ve traded. You’ve tracked. Maybe a messy Excel sheet here, a Notion doc there - screenshots, scattered thoughts, half-finished reviews. It works… kinda. Until it doesn’t.

You miss patterns. You forget why you took that setup. You can’t tell if the problem was the market - or just you.

That’s where TraderInsight.pro comes in. Drop your trades in, add some context, and instantly see what’s clicking - and what’s costing you. Filter by time, setups, mistakes, whatever you need. It’s your process, just sharper.

No bloat. No BS. Just a clean, powerful journal built to help you trade better.

Import Trades from any broker

Import trades from any broker in seconds - Stocks, Forex, Crypto, Options, Futures, Dividends... everything

Log emotions, psychology and more

Trades are more than numbers. Log the emotion. Log the reasoning. Tag the setup. Never lose context on trades again.

Get Intra-day Insights

See how your PnL stacks up by time of day, weekday, or hold time. Are mornings your sweet spot? Are you overstaying winners? It’s all there - no more guessing.

Add Notes to Trades

Hold yourself accountable, capture your thoughts and more. Add notes to trades to keep track of your thinking and decisions.

Tools build for Traders

Intraday PnL

See how you perform at different hours, sessions, and weekdaysTag Anything

Strategies, setups, mistakes - and build reports on top of itShare Privately or Public

Post wins or invite mentors to see everything - your callCompare Strategies

Which setups are consistent? Run a side-by-side breakdownCustom Reports

Build your own charts + KPIs - no stats degree requiredRich Trade Notes

Add context, journaling, or rants directly to any tradeHold Time Insights

Spot when you exit too early - or hold way too longNote templates for lightning-fast reviews

Answer all of these questions (and more) with TraderInsight.pro

- Am I more accurate in the first 30 minutes - or the last?

- How much PnL did I leave on the table by exiting early?

- Which trades felt impulsive… and which were clean?

- Is my win rate improving - or just my risk control?

- Did I size too heavy on losing trades this month?

- Am I overtrading Mondays or skipping Fridays?

- What setups gave me the best R/R this week?

- How does Strategy A perform vs. Strategy B?

- Where do I keep making the same mistake?

- What happens when I trade through FOMC?

FAQ's

Discover answers to frequently asked questions right here. If you can't find what you're looking for then reach out.

What is the free trial?

Day traders need a journal to identify their most profitable trading hours, strategies, and setups. TraderInsight.pro helps day traders track intraday performance, analyze which time windows work best, and eliminate costly mistakes by reviewing detailed performance data.

Can I analyze my most profitable trading hours?

Yes, TraderInsight.pro allows day traders to analyze performance by time of day, helping you identify your most profitable hours. You can filter and compare trades across different time windows to optimize your trading schedule.

Does TraderInsight.pro work for scalping?

Yes, TraderInsight.pro supports all day trading styles including scalping. You can import high-frequency trades, tag different scalping strategies, and analyze performance across multiple timeframes and setups.

How fast can I import day trading data?

TraderInsight.pro offers drag-and-drop import for instant trade uploads. Simply export from your broker and import into TraderInsight.pro in seconds - no manual entry required. The platform is designed to be 100x more efficient than spreadsheets.

Can I add orders and dividends manually?

Yes, TraderInsight.pro supports manual order and dividend entry. You can add orders, trades and dividends manually to your journal for complete control over your trading data.

Can I track multiple day trading strategies?

Yes, TraderInsight.pro's advanced tagging system lets you categorize trades by strategy (momentum, breakout, pullback, etc.), setup type, market conditions, and more. You can then compare performance across all your strategies to identify what works best.

Get started with real insights