Options Trading Journal

From Greeks to expiration analysis, track what matters - and leave the spreadsheets behind.

Options are powerful. But most journals treat them like simple stock trades - missing what really matters.

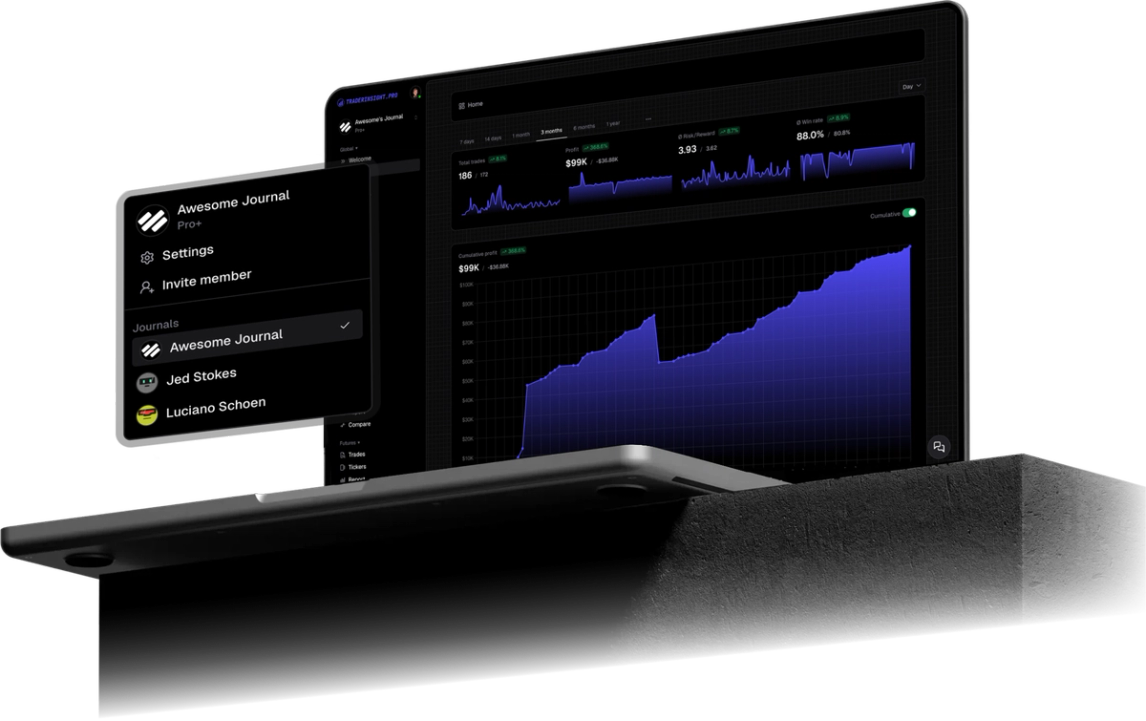

With TraderInsight.pro, every contract, strategy, and outcome gets the spotlight. You get full control: log entry/exit reasoning, track Greeks, group legs, and run deep performance breakdowns across expiration windows, setups, and more.

If you’re trading options - this is the journal built for you.

Tag setups, log your thinking

No more ticker + price. Track your strategy, context, entry reasoning - and build a history you can actually learn from.

See PnL by day, hour, hold time

Filter trades by time-of-day, weekday, or duration to find what really suits your style.

Compare setups, strategies... everything

Stack breakout vs. reversal, Monday vs. Friday - whatever you want. Create filters and compare them in seconds.

Review, reflect, level up

Use notes, custom tags, and tailored reports to dig deep - and stop repeating mistakes.

Tools build for Traders

Rich Trade Notes

Log the trade and the reasoning behind it - from strategy to market context.Expiration Tracking

Sort trades by time to expiration - analyze how 0DTE vs. 30DTE strategies actually play out.Strategy Tagging

Track spreads, condors, naked calls, or whatever you trade - filter and analyze by strategy.Greeks at Entry & Exit

Store delta, gamma, theta, vega, and IV - for both entry and exit. Track how risk evolved.Performance by Strategy

Compare strategies side-by-side: long calls vs. verticals, spreads vs. naked - find your edge.Earnings Play vs. Technical

Sort trades by catalyst - earnings, news, or setup tags - and see what actually performs.Mentor-Ready Journaling

Privately share trades or full journals with mentors for feedback - no screenshots needed.Risk/Reward Analysis

Visualize risk-to-reward ratios across different strategies and trade types.Custom Option Reports

Build fully custom dashboards focused on options: expiration, position size, and more.Answer all of these questions (and more) with TraderInsight.pro.

- Where’s my edge - breakouts, mean reverts, premiums?

- Am I getting paid enough for the theta I risk?

- Do I actually make money on earnings plays?

- Are my spreads or naked calls doing better?

- How often do I actually follow my strategy?

- What’s my average delta at entry and exit?

- How does my win rate change with 0DTE?

- Should I close early or ride to expiration?

- Which tickers do I overtrade?

- How is IV affecting my results?

FAQ's

Discover answers to frequently asked questions right here. If you can't find what you're looking for then reach out.

Does TraderInsight.pro support multi-leg options strategies?

Yes, TraderInsight.pro fully supports multi-leg options strategies including credit spreads, debit spreads, iron condors, butterflies, straddles, and strangles. Import complex positions from your broker and analyze complete strategy performance.

Which options brokers does TraderInsight.pro support?

TraderInsight.pro supports options trading from Interactive Brokers, Charles Schwab, Trade Station Global, E-Trade, Webull, Moomoo, and other major options brokers. New broker integrations are added weekly.

Can I track options premium decay over time?

Yes, TraderInsight.pro allows you to analyze options performance including time decay effects. Track how your strategies perform across different days to expiration (DTE) and identify optimal entry and exit timing for credit and debit strategies.

Does TraderInsight.pro calculate options-specific metrics?

Yes, TraderInsight.pro tracks options-specific performance including premium collected/paid, return on capital, maximum risk metrics, and days to expiration analysis. Tag by strategy type to compare verticals vs iron condors vs single legs.

Can I separate options and stock trades in my analysis?

Yes, TraderInsight.pro automatically categorizes options and stock trades separately. You can filter, analyze, and report on options trades exclusively, or combine them to see complete portfolio performance across all asset types.

Journal your options today