What separates consistently successful traders from those who struggle to maintain gains? It’s not always a sharper strategy or market insight - it’s discipline and consistency. Just like in sports, where brute force might get you some initial wins, sustained success requires constant review, reflection, and improvement. This is where trade journaling becomes a game-changer.

If you’re aiming for long-term success, a trade journal is your personal playbook. It allows you to track what’s working, identify mistakes, and ultimately, make better trading decisions over time.

Building Discipline Through Reflection

In the heat of trading, emotions can easily take over. Fear and greed can cloud judgment, leading to impulsive decisions. Keeping a trade journal helps you maintain control by forcing you to document why you made a certain move, what the market conditions were, and what emotions influenced your decision.

This process builds discipline. Like a quarterback who sticks to a game plan despite pressure, journaling helps you stick to your strategy, even when the market gets volatile. Reviewing your trades allows you to spot when emotions caused you to break from your strategy, and that awareness is key to making more disciplined decisions in the future.

Without reflection, it’s easy to keep making the same mistakes. By writing down your trades and reviewing them regularly, you turn every trade - whether it’s a win or a loss - into a learning experience.

Documenting More Than Just the Numbers

A trade journal isn’t just about recording your wins and losses. It’s about capturing the full picture. Imagine a professional football team only looking at the final score after a game. They wouldn’t learn nearly as much as they would by reviewing the game tapes to analyze each play. Similarly, as a trader, you need to record not just the outcomes, but why you made each trade.

What was your emotional state at the time? Were there external factors that influenced you? Did you follow your plan, or deviate based on gut feeling? Answering these questions in your journal helps you identify patterns in your behavior. Maybe you realize that you tend to exit trades too early when feeling anxious, or that you chase trends after a few losses.

Over time, this kind of self-reflection leads to greater self-awareness and better trading decisions.

Tagging Trades for Deeper Insights

Think of tagging trades as the football equivalent of breaking down specific plays for review. Just like athletes analyze their moves to see what worked and what didn’t, tagging each trade with specific learnings - whether it was a mistake, a strategic insight, or an emotional reaction - gives you a quick way to review your performance.

By tagging trades with "learning moments" or "emotional errors," you can easily spot recurring themes when you look back over your journal. For example, maybe you notice that many of your losses were due to not following your indicators. Or maybe certain setups consistently led to profits. These tags allow you to identify both strengths and weaknesses and make adjustments accordingly.

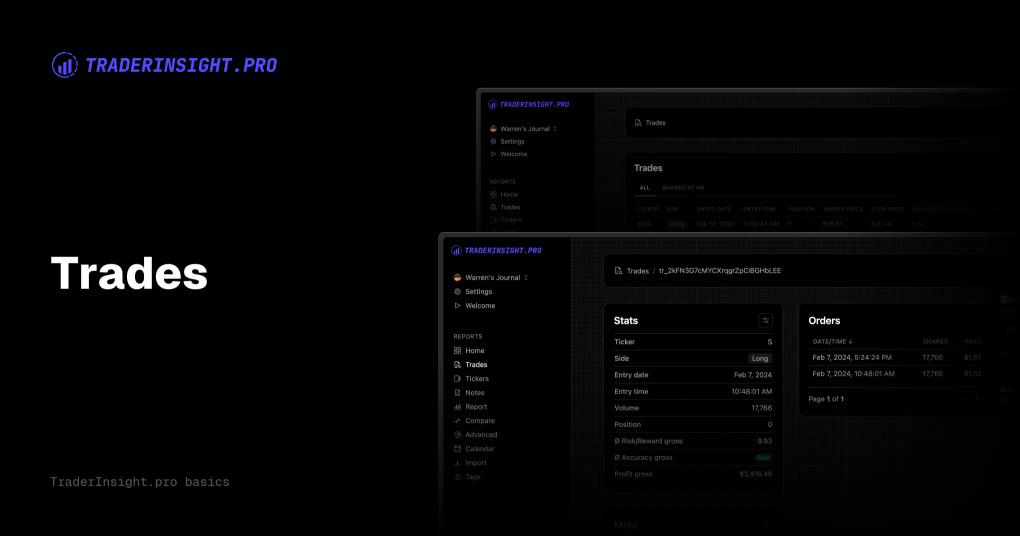

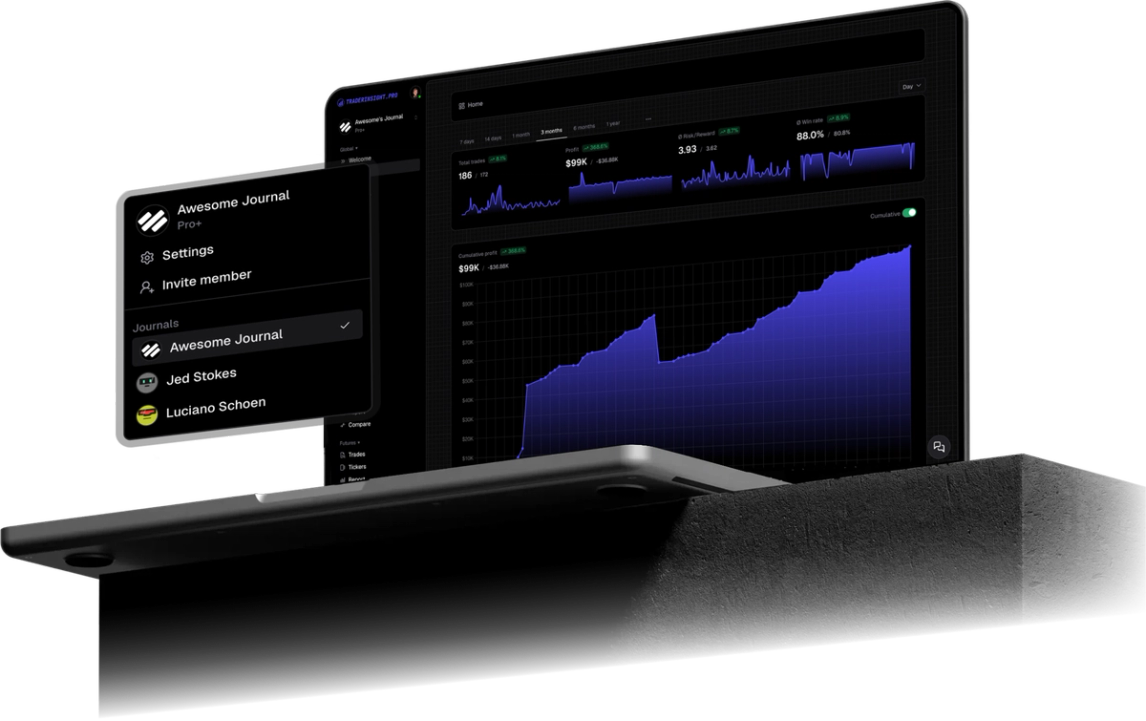

Platforms like TraderInsight.pro make it easy to tag your trades, so you can quickly sift through your journal and pinpoint the areas where you need to improve. It’s like having a personalized coach reviewing your every move.

Building Consistency Through Review

Professional athletes don’t rely on memory alone to improve - they review their performance regularly, analyzing what worked and what didn’t. The same principle applies to trading. Consistency doesn’t come from winging it; it comes from constantly reviewing your trades, refining your strategy, and learning from every win and loss.

A well-kept trade journal is your roadmap to building that consistency. By reviewing your journal regularly, you’ll start to notice patterns that weren’t obvious in the moment. You’ll see which strategies are yielding the best results and which need adjusting. Most importantly, you’ll develop the habit of sticking to what works and avoiding the mistakes that set you back.

TraderInsight.pro was built specifically for this purpose - to help you generate detailed reports, analyze your trade history, and review your performance, just like a pro athlete reviews their game tapes. The more consistently you reflect on your trades, the stronger your habits - and your results - will become.

Final Thoughts

Much like a professional athlete needs to review their past games to improve, traders need to reflect on their past trades to develop consistent success. A trade journal isn’t just a record of your activity - it’s your roadmap for learning, improving, and ultimately achieving your goals in the market.

By committing to journaling your trades and tagging key moments, you’re setting yourself up for long-term success. And with TraderInsight.pro, keeping track of your trades and generating insights has never been easier. Take your trading to the next level by reflecting on each trade and refining your strategy with every entry.