You’ve probably heard about options - and maybe even that they’re risky or complicated.

But they’re also one of the most flexible and strategic tools in trading - once you understand how they work.

Let’s break it down.

No math degree required. Just clear examples and real-world analogies.

What is an option?

An option is a contract that gives you the right, but not the obligation, to buy or sell a stock at a set price before a certain date.

You're not buying the stock (yet). You're buying a ticket that lets you choose to act if the market moves your way.

Think of it like a concert ticket: you have the right to go - but you don’t have to. If your plans change, you can toss it or resell it.

Why do options exist?

Originally, options were designed to hedge risk.

Example: You own 1,000 shares of Apple. You’re bullish long-term - but what if the market dips short-term?

You can buy a put option to protect yourself. It acts like insurance - letting you sell at a set price even if the stock crashes.

Institutions often use options to hedge big positions.

Retail traders? Mostly use them to speculate - and try to turn small bets into big wins.

Two types of options

- Call option - You're betting the stock goes up. It gives you the right to buy the stock at a set price - called the strike price - before the option expires.

- Put option - You're betting the stock goes down. It gives you the right to sell the stock at a set price - also called the strike price - before the option expires.

That’s it. Everything in options comes back to those two.

Every option has:

- A strike price (your target buy/sell level)

- An expiration date (how long the contract lasts)

- A premium (what you pay for the contract)

Example

Let’s say Tesla is trading at $250. You think it’ll hit $270 soon.

You buy a call option with a $260 strike, expiring in 2 weeks. The premium is $3.

- Cost: 1 contract = 100 shares × $3 = $300

- If Tesla hits $270 → the option is now worth $10 per share (At expiration, the intrinsic value = current price - strike = $270 - $260 = $10 per share)

- Sell it for $1,000 → Profit = $700 ($1,000 - $300 cost)

If Tesla stays below $260? Your option expires worthless. Your max loss is the $300 premium you paid.

Think of the premium as a non-refundable reservation fee. You’re paying for the option to act - not the obligation.

Stock vs. Option

Let’s say Tesla is trading at $250 and you want to trade the move to $270.

Stock trade:

- You buy 100 shares at $250 = $25,000

- Tesla hits $270, you sell at $27,000

- Profit = $2,000

Option trade:

- You buy 1 call option with a $260 strike for $300

- Tesla hits $270, the option is now worth $1,000

- You sell it and profit $700 ($1,000 - $300)

Stock = high cost, direct ownership, no expiration → Required a big upfront investment Option = low cost, leveraged exposure, but time-limited → 10x smaller capital requirement but profits can be lower if move is small or slow 🧐

Types of options trading

- Buying calls/puts - Simple directional bets (aka go up/down)

- Selling options - Collect premium, take on risk

- Spreads - Combine options to limit risk or cost

- Covered calls - Own stock + sell calls = passive income

- Advanced strategies - Iron condors, straddles, strangles - Advanced strategies for sideways moves

Options are like LEGOs - once you know the pieces, you can build whatever strategy fits your view.

Why traders like options

- Small capital = big exposure

- Flexible: play up, down, or sideways

- Defined risk (when buying)

- Can be used for speculation OR hedging

- Tons of strategy variety once you learn the basics

- Potentially great for short-term setups and long-term plays

Downsides

- Expire - if the stock doesn’t move fast enough, you lose

- Can lose 100% of your premium

- The pricing (called "Greeks") can get complicated

- Selling options = high risk if unmanaged

- Easy to misuse without a proper plan or strategy

Final thoughts

Options let you trade big ideas with small money - but they’re not magic.

If stocks are owning, and futures are betting - options are renting.

And if you're not managing the clock? The rent runs out.

Track every contract. Review every play. That’s how you get sharper.

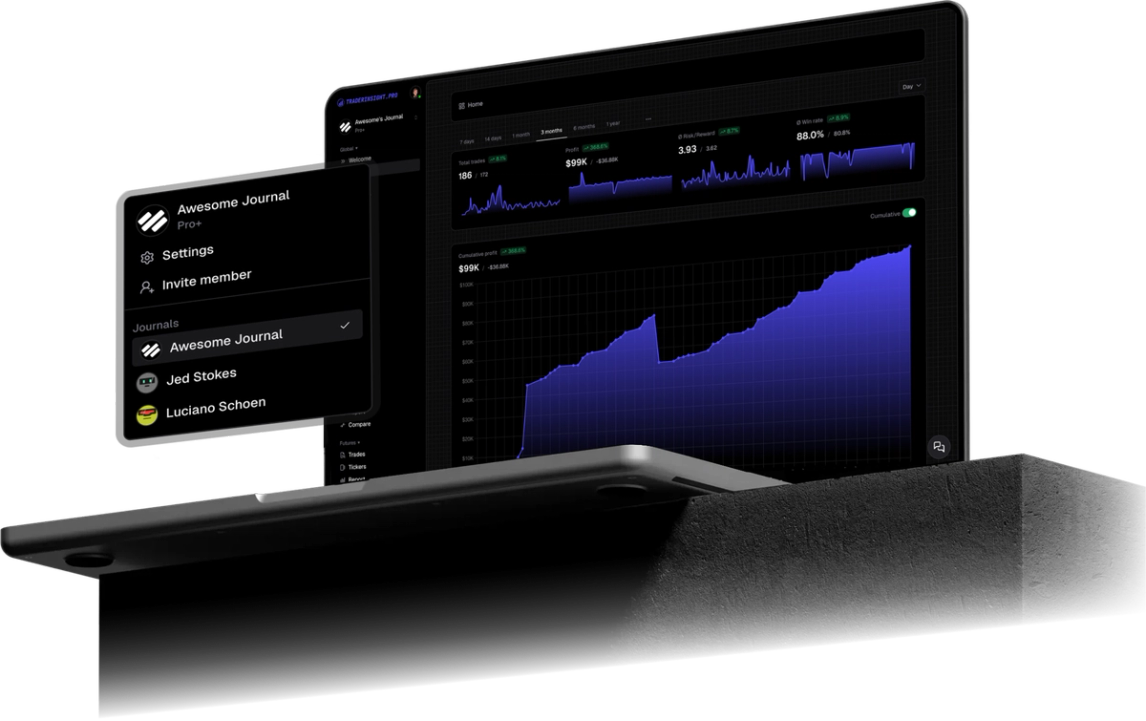

We built TraderInsight.pro to help you do exactly that 💪

Done with the trilogy? 🔁 Go back to:

- Part 1: What Are Stocks?

- Part 2: What Are Futures?