If you’re stepping into trading, chances are you’ve heard about futures - especially when people mention the S&P 500, crude oil, or gold.

But what exactly are futures?

And why do so many traders gravitate toward them?

Here’s the no-BS breakdown: real talk, clear examples, and zero fluff.

What is a futures contract?

When you buy a stock, you own part of a company.

With futures? You’re not buying anything - you’re just making a bet on where the price is going.

A futures contract is a deal to trade something (like oil, gold, or the S&P 500) at a set price in the future - but most traders never hold it that long.

You're in it for the price movement, not the thing itself.

If buying a stock is like buying a house, trading futures is like betting on what the house will be worth next week - without owning it.

Why do futures even exist?

Futures started with farmers trying to lock in prices for their crops before harvest. But the concept exploded because modern businesses needed a way to manage risk.

Take McDonald’s, for example.

They buy millions of pounds of chicken every year.

If chicken prices spike, it destroys their profit margins.

So what do they do?

They use futures contracts to lock in the price of chicken months in advance. That way, they know exactly what they’ll pay - no matter what happens in the market.

It's like saying: “We’ll buy chicken at $1.20/lb in 3 months. Deal?”

If prices go up to $1.50 - McDonald’s wins. If they drop to $1.00 - the supplier wins.

Either way: everyone gets certainty. That’s called hedging.

Today, traders use those same contracts to speculate on price moves - not to buy chicken 😅

Same contracts, different purpose 😉

How do futures work?

Let’s say gold is trading at $2,000/oz. You think it’ll go up.

You buy 1 gold futures contract.

Each contract = 100 ounces of gold

If gold goes up to $2,010?

That’s a $10 move × 100 = $1,000 profit

If it drops to $1,990? That’s $1,000 loss

You never owned the gold. You just made (or lost) money on the price swing.

What’s margin? And how does leverage work?

That gold contract controls $200,000 worth of gold. But you don’t need 200K to trade it.

You might only need $6,000–$8,000 - called initial margin - a kind of “security deposit” that shows you can handle small losses.

So no - the broker isn’t giving you $194K. You don’t get to keep the gold or spend that money.

Instead:

- You're on the hook for the full value change of that $200K position.

- If the trade moves against you by more than your margin (say gold drops $100/oz = $10,000 loss), you could be forced to close the trade or deposit more funds (called a margin call).

It’s like renting a $200K race car with a $6K deposit. If it performs? You win. If you crash it? You’re still on the hook.

This is leverage: small capital controls a big position.

That means faster gains - and faster losses. It can amplify gains and blow up your account faster than you expect.

What’s “1 point” in index futures?

Futures move in points and ticks.

For example:

- In ES (S&P 500 futures), 1 point = 4 ticks

- Each tick = $12.50

- So 1 full point = $50

So if ES moves from 4,500.00 to 4,501.00 → you made or lost $50 per contract

If it moves 10 points? That’s $500.

Keep in mind that other futures (oil, gold, crypto, etc.) might have different tick sizes.

What’s a rollover? Why do futures expire?

Futures contracts have expiration dates - usually monthly or quarterly.

You can’t hold a futures position forever.

If you still want to stay in the trade after expiry, you have to roll over:

- You close your current contract and open the same trade in the next month’s contract.

Most traders roll a few days before expiration to avoid:

- Low liquidity

- Bigger spreads

- Forced closure or physical delivery (yes, that’s a thing for commodities)

You can learn more about rollovers here.

👉 Exchanges publish rollover calendars, and many platforms automate it for you already.

Types of Futures

Futures let you trade a ton of different markets:

- Stock index futures – like S&P 500 (ES), Nasdaq (NQ), Dow (YM)

- Commodity futures – Crude oil, natural gas, gold, wheat, coffee

- Currency futures – euro, yen, pound vs. the dollar

- Crypto futures – BTC, ETH (on certain platforms)

Each contract is standardized - with a tick value, expiration date, and fixed contract size.

Types of futures trades

- Scalping – Super short, in and out in minutes

- Day trading – Enter/exit same day

- Swing trading – Hold for days or weeks

- Hedging – Using futures to reduce risk in other positions (common with institutions)

Why traders like futures

- Trade huge markets with relatively small capital

- Built-in leverage

- Nearly 24/5 access

- No pattern day trading (PDT) rule

- Tons of liquidity and volatility

- You can trade stocks, commodities, currencies, crypto - all from one account

Downsides

- Leverage is a double-edged sword - fast gains, fast losses

- Contracts expire - you need to manage rollovers

- Less beginner-friendly than stocks

- Moves fast - easy to wipe out an account without good risk management (aka mistakes get expensive, fast due to leverage 😬)

Final thoughts

Futures let you trade price movement - not assets.

They’re fast, powerful, and super flexible - but also unforgiving if you’re not prepared.

Want to trade them well?

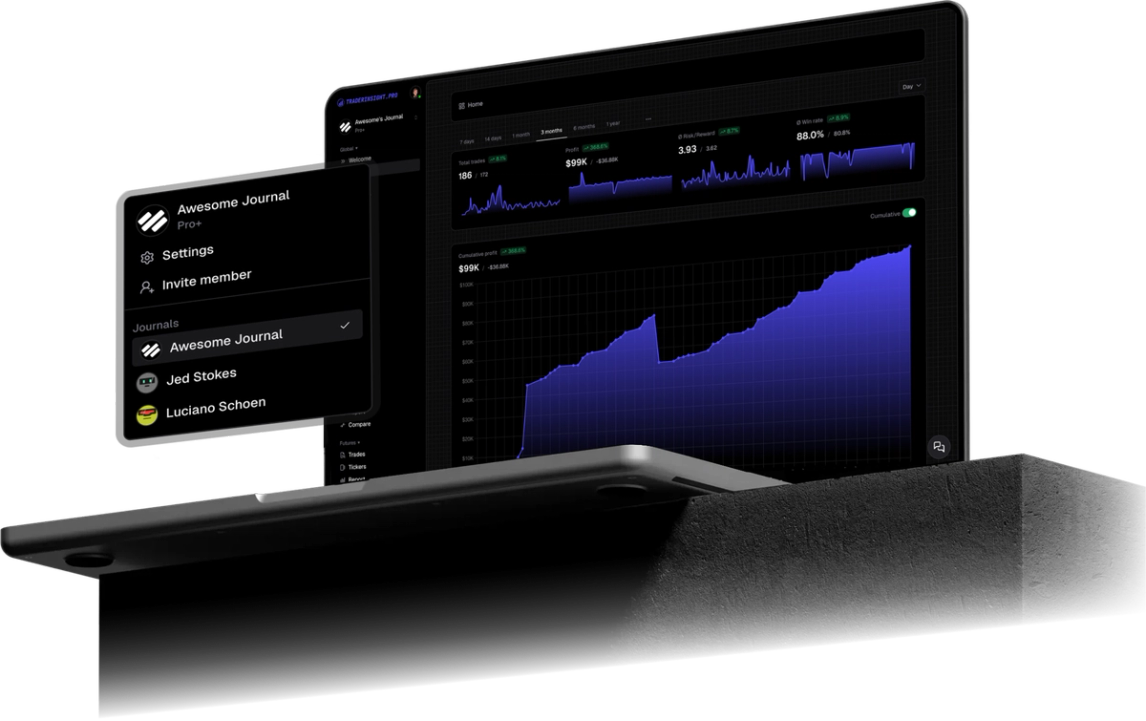

Track your positions. Review your setups. Reflect on your decisions. That’s how you sharpen your edge.

That’s why we built TraderInsight.pro - to help you track every contract, every trade, and every lesson.